By André de Waal and Joost van der Hulst

Two earlier articles discussed the outcomes of large scale trend research into the developments in the Finance function in 2013 and the outline profile of the Financial 3.0. The initial draft of that outline profile read: “The Financial 3.0 is a smart and daring professional service provider who is aware of the current issues within the organisation, is engaged in the business, has an opinion and makes it known to the management, makes choices and sets priorities, and fully completes projects to everyone’s satisfaction, and focuses on the fifteen financial evergreens (i.e. fifteen activities in the finance function which will always be important) in which they are an expert. The Financial 3.0 is someone the business cannot and does not want to avoid, who is thereby viewed as an equal partner by management.” However, a number of comments on this draft soon followed, such as: this description doesn’t refer to the controller’s independence, is “fully completes projects” not a line responsibility?, “being indispensable” should be safeguarded within the organisation, and “equality” implies a sense of inferiority. There was a feeling that the outline profile was still too focused on the traditional interpretation of the Financial’ s role and would not create the desired ‘breakthrough’ towards a Financial who would act as a pioneer within the organisation.

Future structure for the Finance Function

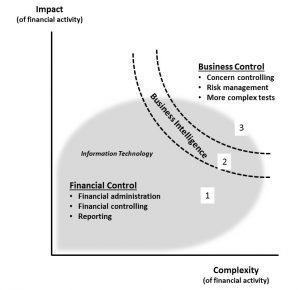

In order to create a better outline profile, the authors conducted a number of workshops with Financials in which they worked on a new structure for the Finance Function in which the Financial 3.0 would find a natural home. This structure is shown in Figure 1. The key idea for the Finance Function 3.0 is to continue allowing line managers to lead with regard to obtaining the financial services that they require at the time they require these. This means that line managers carry out as many financial activities as possible themselves – if they are not too complex and do not have a major impact on the organisation – such as requesting reports (in the form and at the time that they require). To enable this, as many routine transactional activities as possible have been automated, whereby Financial Control ensures that the data and information in those systems is highly reliable (area 1 in Figure 1). This information is accessible to line managers through a business intelligence shell (area 2 in Figure 1), whereby this shell will move increasingly towards the top right as more financial activities are automated and line managers become more financially competent. Business Control will then concentrate on more complex financial activities that have a high impact on the organisation (area 3 in Figure 1). After all, these activities require specialist knowledge that line managers do not have, and they will also require these services less constantly and more on demand. The Finance Function thereby effectively creates a ‘store’ where the line managers can shop for what they need. This structure ensures that line managers do not have financial products imposed on them of which they too often make little use in practice. The line managers decide for themselves what they need and when. The Finance Function can focus on the really difficult activities which provide added value, and will thereby grow to be valued specialists. The size of the Finance Function could also decrease by some 50% because the majority of the work is automated.

New financial services will initially be placed in area 3 of Figure 1 due to their relatively great complexity for the organisation. As experience with the new service grows and the opportunities to automate the service are explored, the service will move to area 2 or area 1.

Support for the HPO from the Finance Function

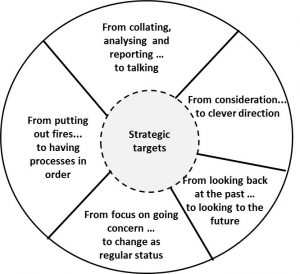

An important question that arose during the research into financial trends and the Finance Function was: If the company makes the transition to a high performance organisation (HPO), what will the high performance Finance Function look like? The following picture emerged in the workshops (see Figure 2). The most important task for the high performance Finance Function is to support the achievement of the organisation’s strategic objectives. The Finance Function can do this by changing its traditional behaviour into high performance achievement-driven behaviour:

- From fire-fighting to having the processes in order. Enable staff working in routine-based and strictly delineated financial processes to improve them themselves (operational lean). Experience shows that many changes to financial processes can be implemented by Financials themselves. Managers of the Finance Function can facilitate this ‘self-sufficiency’ by providing specific improvement training, creating time for process analysis, discussing wastage in staff consultation meetings, and introducing improvement noticeboards.

- From a focus on the normal state of affairs (‘going concern’) to a focus on change (change becoming the normal state). Organisations are constantly in flux, and that change has an impact on the financial processes. Therefore always initiate the change in the financial processes from within the Finance Function itself. Ensure that there are user representatives who, under the leadership of well-trained experts (e.g. green belts), help to continuously implement the correct modifications (i.e. those that the users want) to the financial processes.

- From collection, analysis and reporting of data to entering into dialogue with line management. Improve the tools (business intelligence tools, smart reports) and reduce the number and size of standard reports to the minimum required. This will leave time for talking about what really matters. Assume that line management only needs detailed information if there is a major impact on the organization’s objectives and in the case of complex analyses. As the management of the Finance Function also ensure that the correct grade of employees carry out the correct work: all too often less highly trained employees spend too long on the analysis of complex tasks while highly trained employees spend too much time producing routine reports.

- From reviewing to smart management. Financials are professionally able to analyse a great deal of data and provide line management with all kinds of comments. However, the trick is to know the business so well that rather than providing comments in the form of reviews (‘such and such has risen, has dipped, is notable’), the Financial comes up with ‘challenging questions’ in order to seek the dialogue. Linking content and figures and challenging the business to come up with its own scenarios and solutions will improve the effectiveness and quality of the advice. The Business Controller thereby provides support to line management for complex and large scale problems, and then withdraws again. It is through this process of support and education that the Finance Function helps the organisation as a whole to develop. The management of the Finance Function will therefore have to pay close attention to developing the Financials’ communication skills so that they can talk about the context of internal and external developments whilst they are close to the business.

- From looking back at the past to looking forward to the future. It is important – particularly for Business Control – to safeguard an organisation’s focus on the long term. When discussing the past with line management information is still too often outdated, while the business itself has more recent information available. This is why looking backwards should be restricted to the points from which future projections can be updated and improved. Working with models and scenarios and striving to harmonise with the parts of the business that develop organisational strategy allows (financial) interventions to be implemented more quickly.

Financial Control should thereby focus primarily on the left-hand side of Figure 2, since that is where the Finance Function’s standard transactional activities are to be found; these are the main tasks in area 1 of Figure 1. Business Control mainly deals with the right-hand side of Figure 2, since that is where the management support activities are located (area 3 in Figure 1). It should thereby be noted that both types of Control need to be able to enter into dialogue with line management: Financial Control about standard financial activities such as reports; Business Control about the more complex financial services which are available on demand. Both types of Control should also be change-minded: Business Control because it will receive constantly changing requests from the business, and Financial Control because it has to deal with technologies which are constantly developing.

Figure 2 provides the opportunity to tie the five factors of the HPO Framework to the new interpretation of the Finance Function 3.0 role. After all, if an organisation focuses on improving the five HPO factors it will achieve better results over a long period of time, which means that Financials need to focus on strengthening these factors. A brief description of the five HPO factors and their relationship with the Finance Function 3.0 is given below (See Figure 3):

- Quality of management

Managers of HPOs are characterised by integrity, decisiveness, being action-oriented, being achievement-oriented, effectiveness, self-confidence and a strong leadership style. All their actions and their work approaches are guided by principles such as being customer-oriented, quality thinking and continuous improvement, and they thereby inspire others to achieve excellent performances together. It is important for both the Financial Control and the Business Control sides of the Finance Function to have good management in order to be able to manage and achieve improvement in the quality of transactional (Financial Control) and management (Business Control) processes. - Quality of staff

Employees of an HPO want to be held accountable for their results and also want to be inspired to achieve outstanding results. They are flexible and determined in achieving their objectives and the diversity of their competencies means that they complement one another. It is important for both the Financial Control and Business Control sides of the Finance Function to have high quality staff who are able to raise the execution of the financial processes to an excellent level and keep it there. Both types of Control should challenge their staff by knowing their motivations and ambitions and thus ensuring the right allocation of tasks. - Openness and being action-oriented

HPOs encourage interactive internal communication (‘an open dialogue’) between members of an organisation so that there is a free and continuous vertical and horizontal exchange of information. Because it is very important for the Finance Function 3.0 to be in dialogue with line management about transactional financial (Financial Control) or complex high impact (Business Control) activities, the Finance Function should work on its skills in this area. - Continuous improvement and updating (innovation)

HPOs have a unique strategy that clearly differentiates them from competitors or comparable competitors. HPOs thereby continuously update and improve their processes, products and services in order to be able to implement that unique strategy. Because change is the normal state in an HPO, the Finance Function should not only be able to handle this, but should also be able to take the lead in the continuous improvement of the organisation and of the function itself. - Long-term thinking

Survival – i.e. continued existence in the long term – always comes before short-term profit at an HPO. This will be embedded in the strategic objectives which are the ‘driving force’ for the Finance Function 3.0.

Figures 1, 2 and 3 provide a practical interpretation of how the Finance Role 3.0 can be structured in such a way as to be able to actively support the organisation in becoming and remaining an excellent organisation. The Finance Function will thereby meet the requirement that an HPO stipulates for every support department: don’t just become high achieving yourself, but also actively help the rest of the organisation with this and thus justify your existence!

For more information about the HPO Framework, HPO Diagnosis, our lecturers, HPO Experts, workshops and Master Classes, please contact us (vink@hpocenter.com or T. +31 (0) 35 – 603 70 07).

Dr André de Waal MBA is associate professor at the Maastricht School of Management and academic director of the HPO Center (www.hpocenter.nl) and is the author of What makes a high performance organization? (2nd edition, HPO Center BV). Joost van der Hulst RA RE is Finance & Control Director at the Sociale Verzekerings Bank (Jvanderhulst@svb.nl). The authors would like to thank the participants in the 2013 Finance4Care Seminar “Transition to a high performance organisation” for their input and ideas.

In 2016 the new book of Dr de Waal, titled the High Performance Finance Function, will be published.